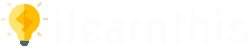

Ten dollars today does not buy as much as it did 30 years ago. The cost of almost everything has gone up. This increase in the overall prices is known as inflation, and it is one of the primary concerns of economists and policymakers.

- Inflation rate

- Consumer Price Index

- Causes of inflation

- Effects of inflation

- Is inflation good or bad

- Effect on wages

- The social cost

Moreover, inflation not only affects just goods and services but also wages and income levels.

Inflation Rate

The inflation rate measures the percentage change in the average level of prices from the year before.

When the inflation rate is more than zero, prices are rising. When it drops under zero, prices are declining. If the inflation rate declines but remains positive, prices are rising but at a slower pace.

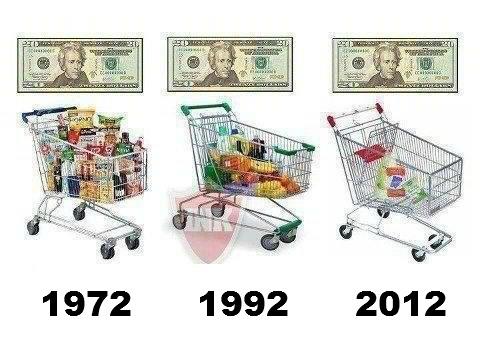

Inflation Rate formula

For instance, if the cost of goods and services in an economy is now $11 and in the previous year the same was $10, then, the inflation is $1.

Inflation rate can be calculated with the formula below,

Here, CPIx stands for initial consumer index.

In the inflation rate formula, we basically find the difference between the previous year and current CPI and, divided the difference by the previous year’s consumer price index.

Consumer Price Index

The CPI or “consumer price index” is a measurement of the overall price of all goods and services purchased by a regular customer.

Now in the United States, inflation is measured with the Consumer Price Index, CPI.

It’s a price index. Also, it measures a general increase or a general change in the level of prices.

Causes of Inflation

The reason for inflation can be summed up in one sentence: Too many dollars chasing too few goods.

Economists distinguish between two types of inflation.

Demand-Pull Inflation and Cost-Push Inflation. Both kinds of inflation cause an increase in the overall price level in an economy.

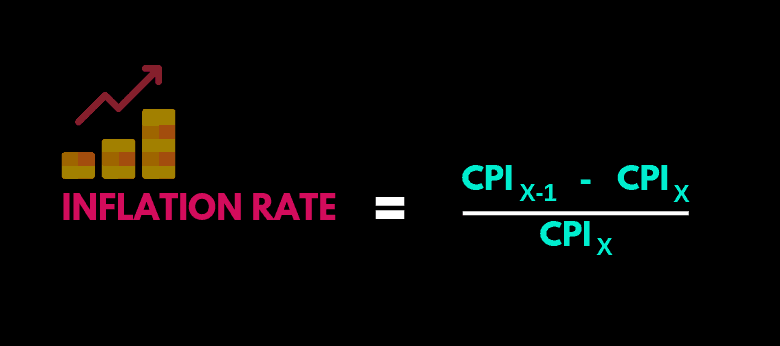

01 Demand-pull inflation

One potential shock to aggregate demand might caused by central banks as central banks can swiftly increase the supply of money in the market.

The graph above shows what will likely happen as a result of this money infused in the market. The increase in cash in the economy will increase the demand for goods and services(from D0 to D1) as people will have more money to spend.

In the short run, companies cannot improve productivity, so supply (S) remains consistent in the market. Moreover, an economy’s equilibrium shifts from point A to point B and prices will tend to increase, resulting in inflation.

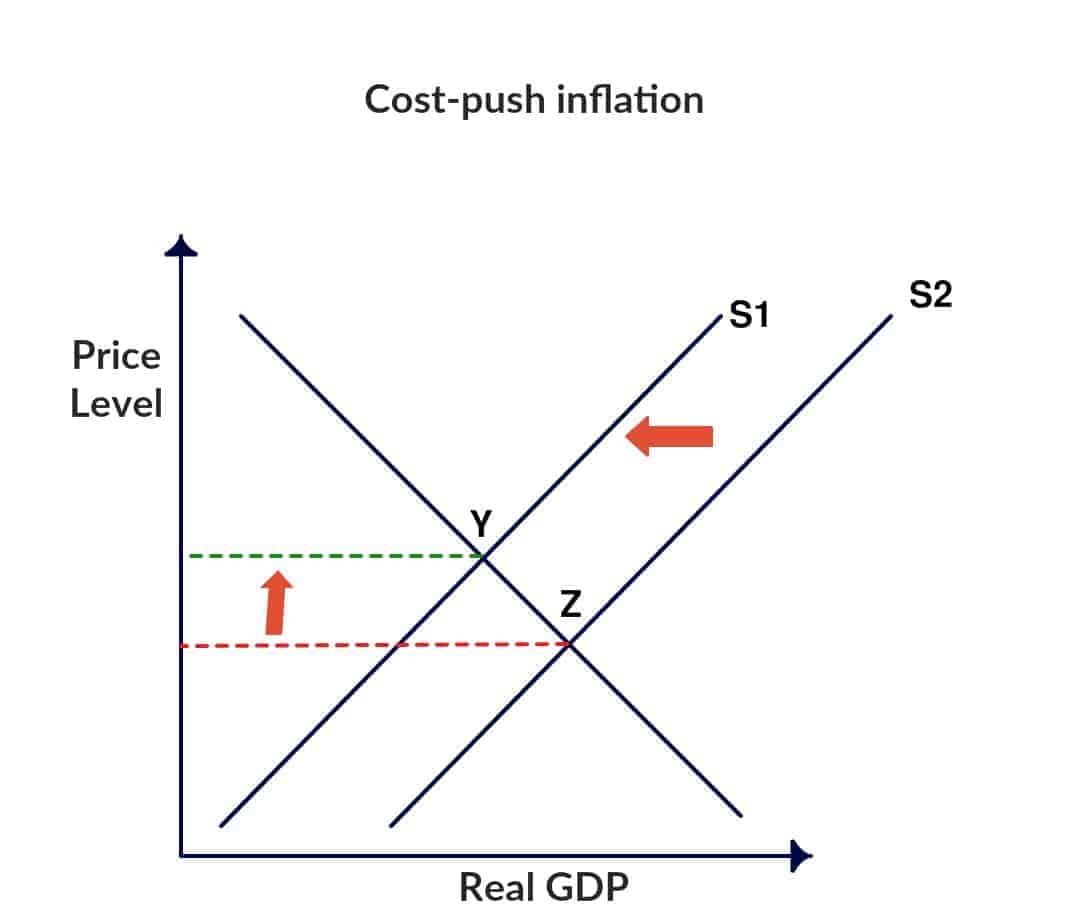

02 Cost-push inflation

When the cost of producing something increase for any reason such as the shortage of raw materials, Significant wage increases in the short period are causes of Cost-push inflation.

For example:

The rise in the price crude oil during the 1970s presents a typical case of cost-push inflation as shown in a graph below.

Soaring energy prices induced the cost of manufacturing and transporting goods to boost.

Soaring production costs led to a decrease in supply and an increase in the overall price level because the equilibrium point shifted from Z to Y.

In a real economy, it can be difficult to pinpoint a single cause of inflation. Nevertheless, knowing what inflation is and what circumstances might cause it is an excellent start for policymakers.

Effects of High Inflation

The increase does not affect only one product but can have changed the price of other goods as well.

For instance, If for whatever reason oil supply is low in a country like the United States, then the price of oil and gas would go up which is quite apparent.

However, then it affects a whole set of things, even the price of bananas and other similar goods that you buy at the grocery store.

Because to get that banana to your store, it needs transportation, and most typed of transportation need to use some gasoline to run the vehicles.

A significant fraction of that banana in that store was probably the cost of transportation from wherever it was grown to your grocery store and then on a railroad and later on a truck.

So it is clear this would affect the general prices, not just the prices of oil or gas.

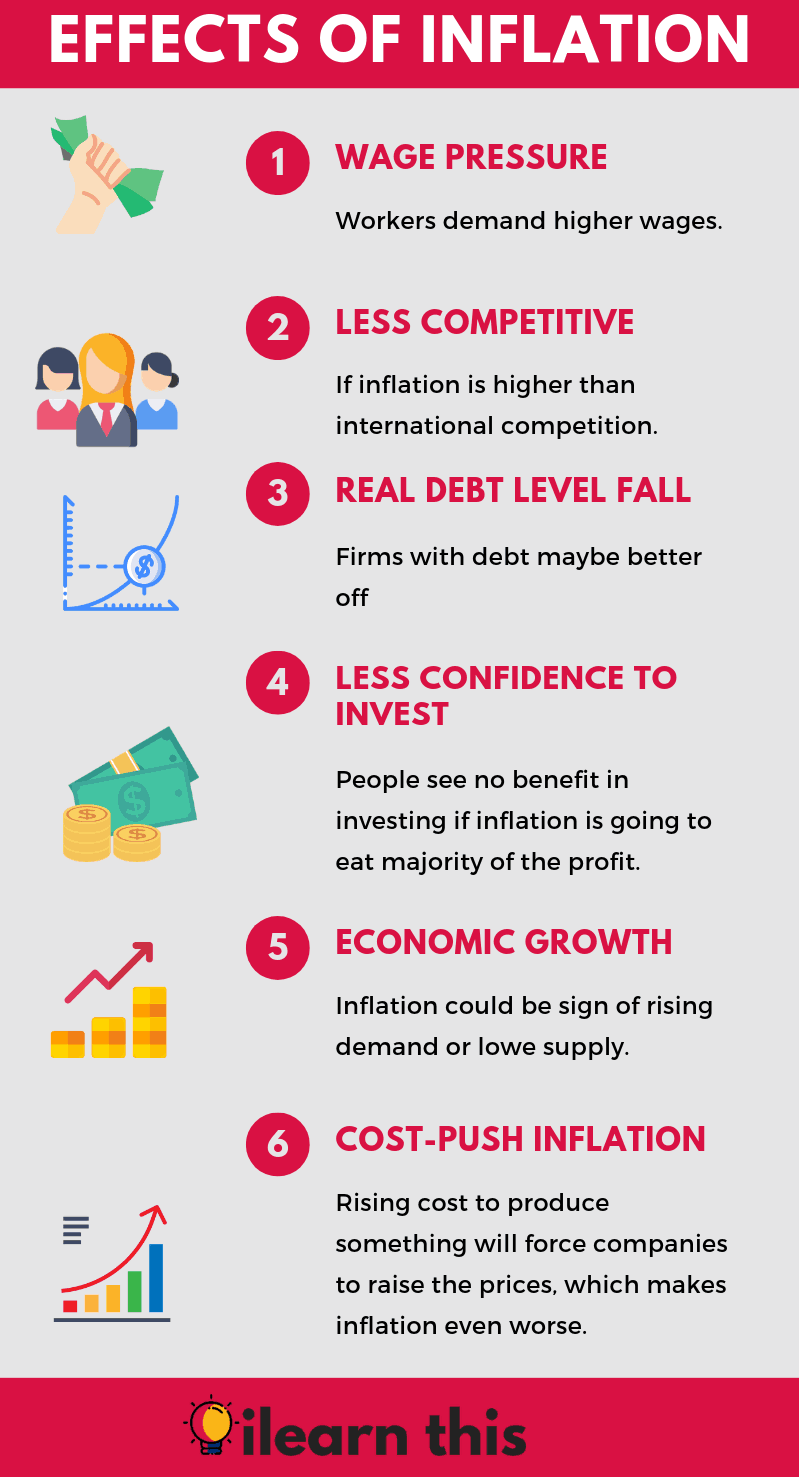

The infographic below is self explanatory about the effects of inflation.

Is Inflation good for Economy?

In general little bit, Inflation is a good thing.

Most central banks favor an inflation target that is in the around 2% to 3%. Some economists believe there should be a higher target for inflation during a recession, such as 3.5%.

Higher inflation can incite higher growth, by keeping interest rates lower for a more extended period.

Economists are also afraid if inflation were ever to get negative.

That leads to deflation, which isn’t considered a good thing in the economy.

When inflation is higher than expected, it is terrible for the economy, businesses, famlies, and individuals.

Inflation decreases the value of money unless interest rates are higher than the increase in inflation. Moreover, the higher inflation gets, the less chance there is that savers will see any real return on their money.

What effect does inflation have on wages?

Soaring prices of goods can make it easy for companies to increase salaries.

Though employers may not

If there is no inflation, Many businesses most likely have to reduce the staff or cut wages of exsisted workers.

The Social Costs of Inflation

If you ask the ordinary person why inflation is a social problem, he will probably answer that inflation makes things expensive for him/her.

“Each year my boss increase my salary, but things get expensive, and that takes some of my increase away from me.’’

The opinion in this comment is that if there is zero inflation, he would get the exact pay rise and be able to buy more goods or get richer.

This objection about inflation is a fundamental delusion.

The purchasing power of labor means the real wage, depends on the marginal productivity of work, not on how much money the government is printing.

If the government reduced inflation by slowing the rate of money growth, workers would not see their real wage increasing more rapidly.

Instead, when inflation slowed, firms would raise the prices of their goods regularly and, as a result, would give their workers less pay raise.

The classical theory of money describes a change in the overall price level is like a change in the units of measurement.

Let’s Imagine

That tomorrow morning you realized, for some strange reason, suddenly all dollar figures in the economy have been multiplied by ten.

The value of every good or service you buy has increased tenfold, but so has your earnings and the amount of your savings. Would this make any difference?

Nothing really except making your wallet heavy.

Your financial prosperity depends on relative prices, not the overall price level.