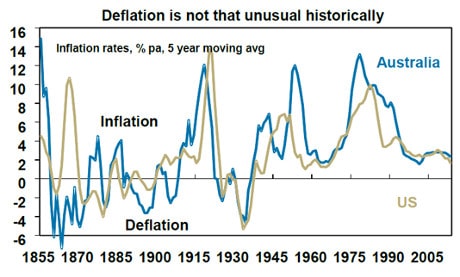

Deflation means a general decrease in the level of prices for goods and services.

Alternatively, another way to think about it, since inflation is an increase in the level of prices, you can say deflation is negative inflation.

Considering inflation is a time when the buying power of money regarding goods and services is low, deflation will be a time when the buying power of money concerning goods and services increases.

Deflation is literally a negative deflation.

Other way to look at deflation is, When the inflation rate is more than zero, prices are rising.

When inflation rate drops under zero, prices are declining and in deflation stage. If the inflation rate declines but remains positive, prices are rising but at a slower pace.

So, We hope basics are clear, let’s understand deflation in depth by learning it’s effects, causes and how to stop it.

Effects of Deflation

You may think that lower prices are a good thing, but deflation is a curse because it generates a vicious circle

If prices go down the profits of businesses, tend to go down with them, and the economy suffers. Many people therefore either lose their jobs or have to accept lower wages.

When people have less money, they consume less and demand for goods and services go down. The consequence of reduced demand will make the problem worse.

This scenario begins an overall drop in prices as producers are forced to cash stock that people no longer want to buy.

Everyone start holding onto cash reserves to cushion against further economic loss.

As more cash is saved, less capital is in circulation, farther decreasing aggregate demand.

At this point, consumer’s expectations about future inflation are lowered, and they begin to hoard money.

Think about it,

Why would you spend their money today when you could buy more stuff tomorrow with the same amount of money?

From 1929 to 1933 the price level plummeted more than 25%.

Some economists blame this deflation for the severity of the Great Depression.

Deflation turned what in 1931 was a typical economic downturn into an unusual time of soaring unemployment and lower income.

What Causes Deflation

Deflation happens because of different factors such as a shortage of money in circulation.

Less cash in circulation raises the value of money as fewer people want to spend their money, which reduces prices even further

Increase supply, then market demands force businesses to lower their rates to get some sales.

How to stop deflation

Deflation hurt the economy in the short term, Though it is ultimately pretty easy for a central bank to counter. Central banks have to print more money.

When they print more money, the supply of money rises, and demand drops.

This increased cash flow breaks the deflationary cycle, where a perceived shortage of money causes the economy to value the money more than what it will buy.

If unchecked, this causes production dropoffs, which cause layoffs, which reduce spending as people hoard cash for necessities, perpetuating the cycle in the absence of a money-creating central authority.

On the other hand, No matter how little you spend, in a consumer economy, you have to buy something.

The demand for human necessities tends to help anchor the value of a currency, even as prices of discretionary items plummet.

No matter how frugal you get, no matter how many debt obligations you walk away from, you still need food.

so while crashing oil prices might lower the cost to put a loaf of bread on the shelf, there is a price at which if you don’t buy it, someone else will.

During the Great Depression the Federal Reserve was supposed to stop such a deflation spiral by releasing the gold that it had been

In fiat currency systems, a deflation can always be stopped by the central bank.