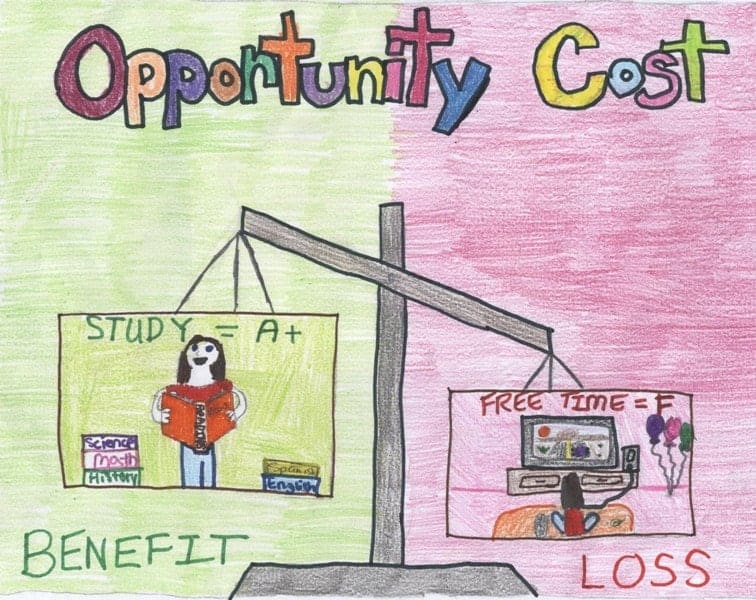

The opportunity cost of an item in an economics term refers to the value of what you have to give up in order to choose something else.

In simple words, it makes sense to think about opportunity costs from the perspective of ‘what do I sacrifice?’ versus ‘what do I gain?

When making any decision, such as whether to study or go for Sports classes. Decision makers should be aware of the opportunity costs with each possible action.

In fact, they usually are. Students who can earn millions if they drop out of school and play professional sports. Are well aware that their opportunity cost of college is very high. It is not surprising that they often decide that the benefit is not worth the cost.

Explicit Costs

Explicit costs are opportunity costs that involve direct monetary payment by producers.

For instance, if a firm spends $500 on the telephone bill, its explicit opportunity cost is $500.

This cash expenditure represents a lost opportunity to buy something else with money.

Implicit Costs

Implicit costs are the opportunity costs that are not shown in cash outflow. Instead implied by the failure of the company to divide its existing assets to better use.

For example.

A manufacturer has previously purchased 70 tons of copper and the machinery to produce

The opportunity cost of producing the copper wires is the revenue lost by not selling the copper and not renting out the machinery. Instead of using it for production.

Let’s look at an examples of opportunity cost

Example of Opportunity Cost.

The farmer and the rancher each spend 40 hours a week working. Time spent producing potatoes, thus, takes away from time available for producing meat.

As the rancher and farmer change their allocations of time between producing the two goods. They move along their production possibility frontiers. In a sense, they are using one good to produce the other.

The opportunity cost measures the tradeoff that each of

Let’s first consider the rancher’s opportunity cost.

Producing 1 pound of potatoes takes her 8 hours of work. When the rancher spends that 8 hours producing potatoes, she spends 8 hours less producing meat.

Because the rancher needs only 1 hour to produce 1 pound of meat, 8 hours of work would yield 8 pounds of meat. Hence, the rancher’s opportunity cost of 1 pound of potatoes is 8 pounds of meat.

Now consider the farmer’s opportunity cost. Producing 1 pound of potatoes takes him 10 hours. Because he needs 20 hours to produce 1 pound of meat, 10 hours would yield 1/2 pound of meat. Hence, the farmer’s opportunity cost of 1 pound of potatoes is 1/2 pound of meat

| 1 POUND OF MEAT | 1 POUND OF POTATOES | |

| Farmer | 2 lbs Potatoes | 1/2 lb Meat |

| Rancher | 1/8 lb Potatoes | 8 lbs Meat |

Above shows the opportunity cost of meat and potatoes for the two producers.

Notice that the opportunity cost of meat is the inverse of the opportunity cost of potatoes.

Because 1 pound of potatoes cost the rancher 8 pounds of meat, 1 pound of meat costs the rancher 1/8 pound of potatoes.

Similarly, because 1 pound of potatoes cost the farmer 1/2 pound of meat, 1 pound of meat costs the farmer 2 pounds of potatoes.

Formula

There is no defined or agreed on

Opportunity cost = return of most lucrative option not chosen – return of chosen option

This value may or may not be measured in money. Value can also be measured by other means like time health or greater good

One formula to calculate opportunity costs could be the ratio of what you are giving up to what you are gaining. If we think about opportunity costs like this, then the formula is very simple.

Let’s look an example to calculate opportunity cost

Assume you have $100 and have two options in front of you:

- Option 1: Put it in a fixed deposit which returns 10% after an year.

- Option 2: Invest in a lemonade business (returns unpredictable)

In Option 1, you have $110 dollars at the end of the year.

Suppose you chose Option 2, and made returns of 5% and ended up with $105.

Here, the Opportunity cost would be: 110 – 105 = $5

Hence, the cost of the opportunity that you let go because of having to choose one alternative over other.

Benefits of Knowing Opportunity Cost

While financial reports do not show opportunity cost. Companies can use it to make educated decisions when they have many options before them.

Because they are unseen by definition, Opportunity costs can be overlooked if one is not careful.