Gross domestic product (GDP), is one way of measuring the size of the economy, but it’s not the only way. There are other measures of national income which help us determine the size of the economy.

Such as calculating Gross national product(GNP), Net national product (NNP) or National Income.

Measures of National Income

It is important to be aware of the various measures because economists and the press often refer to them. These measures also give you a clear picture of the national economy.

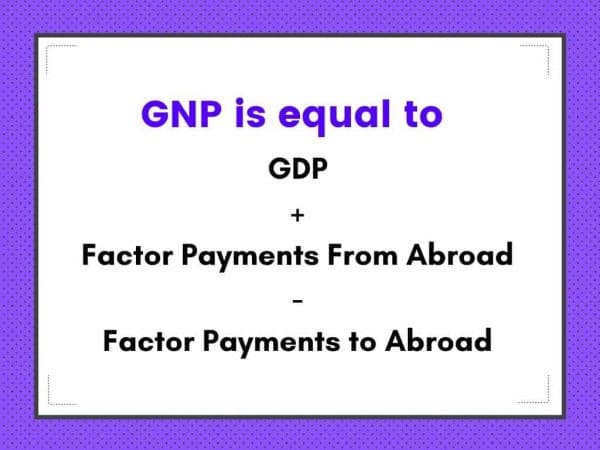

01 Gross national product (GNP)

To obtain the gross national product (GNP), we add receipts of factor income (wages

Whereas GDP measures the total income produced domestically, GNP measures the total income earned by nationals (residents of a nation).

For instance, if a Japanese resident owns an apartment building in New York, the rental income he earns is part of the U.S GDP because it is earned in the United States

But because this rental income is a factor payment abroad, it is not part of U.S GNP

In the United States, factor payments from abroad and factor payments abroad are similar in size, each representing about 3 percent of GDP. So GDP and GNP are quite close.

02 Net national product (NNP)

To obtain the net national product (NNP), we subtract the depreciation of capital — the amount of the economy’s stock of plants, equipment, and residential structures that wear out during the year:

NNP = GNP − Depreciation.

In the national income accounts, depreciation is called the consumption of fixed capital. It equals about 10 percent of GNP.

Because the depreciation of capital is the cost of producing the output of the economy, subtracting depreciation shows the net result of economic activity.

03 National income

The next adjustment in the national income accounts is for indirect business taxes, such as sales taxes.

These taxes, which makeup about 10 percent of NNP, place a wedge between the price that consumers pay for a good and the price that firms receive. Because firms never receive this tax wedge, it is not part of their income.

Once we subtract indirect business taxes from NNP, we obtain a measure called national income.

National Income = NNP − Indirect Business Taxes

National income measures how much everyone in the economy has earned.

The national income accounts divide national income into five components, depending on the way the income is earned. The five categories and the percentage of national income paid in each category are the following:

- Compensation of employees (70%).The wages and fringe benefits earned by workers.

- Proprietors’income (9%).The income of noncorporate businesses

, such as small farms, mom-and-pop stores, and law partnerships. - Rental income (2%).The income that landlords receive

, including the imputed rent that homeowners “pay’’ to themselves, fewer expenses, such as depreciation. - Corporate profits (12%).The income of corporations after payments to their workers and creditors.

- Net interest (7%).The interest domestic businesses pay minus the interest they receive

, plus interest earned from foreigners.

A series of adjustments takes us from national income to personal income, the amount of income that households and noncorporate businesses receive

Three of these adjustments are most important.

First, we reduce national income by the amount that corporations earn but do not payout, either because the corporations are retaining earnings or because they are paying taxes to the government

This adjustment is made by subtracting corporate profits (which equals the sum of corporate taxes

Second, we increase national income by the net amount the government pays out in transfer payments.

This adjustment equals government transfers to individuals minus social insurance contributions paid to the government.

Third, we adjust national income to include the interest that households earn rather than the interest that businesses pay.

This adjustment is made by adding personal interest income and subtracting net interest. (The difference between personal interest and net interest arises in part from the interest on the government debt.)

Thus

Personal Income = National Income

− Corporate Profits

− Social Insurance Contributions

− Net Interest

+ Dividends

+ Government Transfers to Individuals

+ Personal Interest Income.

Next, if we subtract personal tax payments and certain non-tax payments to the government (such as parking tickets), we obtain disposable personal income:

Disposable Personal Income = Personal Income − Personal Tax and Nontax Payments.

We are interested in disposable personal income because it is the amount households and noncorporate businesses have available to spend after satisfying their tax obligations to the government.

Summary

So we learned the different ways of measures of National Income. GNP measures the total income earned by citizens of a nation domestically and abroad.

NNP measures depreciation of capital from total “Gross National Product(GNP)”. Whereas the National Income makes adjustments in the national income accounts for indirect business taxes, such as sales taxes.